This week, Secure PERA and our coalition partner, CSPERA, hosted a webinar with over a 100 PERA retirees from across the state.

Rep. Julie McCluskie, who serves on the powerful Joint Budget Committee and represents House District 61 covering Delta, Lake, Gunnison, Pitkin and Summit Counties, joined us to discuss the 2020 budget and what it meant for PERA.

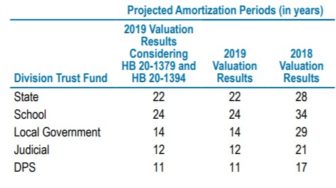

Ron Baker, Executive Director of PERA, provided an update on the status of the pension system and how the market changes and the loss of the $225 million contribution from the state could impact retiree benefits going forward.

You can watch a recording of the webinar here. Presentations from the webinar can be found here.